Direct deposit vs paper check tax refund

Rated 5/5 based on 113 customer reviews January 23, 2020

An essay on man epistle 1 meaning

Lancia thesis 2.4 jtd review

Write discussion chapter dissertation

In a research paper a thesis statement should

Essays of schopenhauer amazon

Harvard business application essays

Thesis english language teaching

Algebra 1 homework help

Case studies on stress management

Dyw be your best self essay

Concluding a dissertation

An essay on man epistle 1 meaning

Fifty great essays 5th edition ebook

Chemosynthesis on other planets

Case studies on stress management

Dissertation zur erlangung des doktorgrades der medizin

Emerson essays second series 1844

Dyw be your best self essay

Admission essay questions

Les mouches sartre dissertation

Admission essay questions

Essay about american constitution

In a research paper a thesis statement should

Essays of schopenhauer amazon

Ford mustang research paper

Essay questions on nietzsches beyond good and evil

Psoriasis paper term

Essay questions on nietzsches beyond good and evil

My favorite bird peacock essay

Thesis statement for young goodman brown by nathaniel hawthorne

In a research paper a thesis statement should

Essays of schopenhauer amazon

Essays on em forster

Against abortion thesis statement

Beowulf statement thesis

Essay about american constitution

Essay on english as a means of communication

Employee attrition research papers

City life versus country life essay

In a research paper a thesis statement should

Cover letters for employment resumes

Report of thesis revisions

Term paper about family planning

English essay words

Essay logical philosophy

Cover letters for employment resumes

An essay on man epistle 1 meaning

Richard taylor fatalism essay

Essay vs prose

Les mouches sartre dissertation

Lancia thesis 2.4 jtd review

An essay on man epistle 1 meaning

Format for writing a masters thesis

Case study research method

Essay questions on nietzsches beyond good and evil

Essay questions oliver twist

Proquest dissertation advanced search

Admission essay questions

Format for writing a masters thesis

Algebra 1 homework help

Reference page for an essay

Les mouches sartre dissertation

Sigmund freud research on behavior

Literature review essay introduction

Thesis statement for skin cancer speech

Chemosynthesis on other planets

Employee attrition research papers

Admission essay questions

Chemosynthesis on other planets

Ford foundation dissertation diversity fellowships

Essay logical philosophy

Alternatives to piaget critical essays on the theory

Richard taylor fatalism essay

Employee attrition research papers

Dissertation zur erlangung des doktorgrades der medizin

Richard taylor fatalism essay

Essay vs prose

Direct deposit vs paper check tax refund

Essay logical philosophy

Essay about the person i admire

Case study research method

Check my personal statement online

Essential question for essay writing

No water no life essay

Essays on the role of government

first paragraph of persuasive essay - The IRS uses the same electronic transfer system to deposit tax refunds that is used by other federal agencies to deposit nearly 98% of all Social Security and Veterans Affairs benefits into millions of accounts. Direct deposit also avoids the possibility that a refund check could be lost or stolen or returned to the IRS as undeliverable. Start Date Tax Return Accepted by IRS (WMR status = Return Received) IRS Refund Accepted Week Ending Date (WMR status = Refund Approved) Estimated Refund Date (via Direct Deposit) Estimated Refund Date (via Paper Check) February 12, February 21, March 5, March 19, February 22, February 28, March 12, Feb 12, · File electronically and use direct deposit. The IRS says that paper-filed tax returns and paper checks will take even longer this year. One out of five taxpayers don’t get their tax refunds by. quality research papers sale

Cornell critical thinking test level x 2005

ethics nursing practice essays - If you file your tax return electronically, the IRS will generaly process direct deposit refunds within days of receiving your tax return, and process paper checks within about two weeks. Filing a paper tax return may delay your refund by up to several weeks. Aug 25, · If your direct deposit or check for your interest is less than $10 (and you don't receive a Form INT), write a note or put a reminder on your phone to let you know that you need to report. Jun 04, · Q: I requested a direct deposit refund. Why are you mailing it to me as a paper check? There are three possible reasons. They are as follows: We can only deposit refunds electronically into accounts in your own name, your spouse's name or in a joint account. A financial institution may reject a direct deposit. We can’t deposit more than three. literature review essay introduction

Good graduate application essays

informative speech thesis outline - The IRS will use your adjusted gross income information in the latest tax return filed ( or ) to determine the amount of your stimulus payment and will deposit your stimulus payment based on the latest direct deposit information. If your tax return doesn't indicate a direct deposit account, you'll receive a paper check. Jan 17, · The IRS already distributed over million payments by direct deposit. On Jan. 8, the IRS announced that it would start sending 8 million debit cards along with an unspecified number of paper. Jan 04, · The tax agency said it began distributing direct deposits Tuesday night, and will start mailing paper checks December academic writing companies in australia

I believe in trust essays

marching band essays - Jan 02, · “When available, electronic direct deposit will be used in place of mailing a paper check,” the committee added. ‘It’s now or never to get the stimulus’ Not necessarily. Feb 07, · If you e-file your taxes and choose to receive your refund as a direct deposit, you’ll get it more quickly than if you file with paper and receive your refund with a paper check. Nov 19, · Paper checks vs. direct deposit. Direct deposit is considered an electronic funds transfer (EFT) that deposits an employee’s wages directly into their bank account. Employers distribute paper checks to their employees. You can either hand write checks or print them on check stock paper. The checks typically list the employee’s name, the. term paper about family planning

Dissertation zur erlangung des doktorgrades der medizin

photo essay about nature - Jan 13, · Your most recently filed tax return if you received a refund by direct deposit in If you registered your banking information for the first check through the IRS' Get My Payment online tool. Paper refunds are covered by the Check Forgery Insurance Fund (CFIF). The CFIF is a fund that settles non-receipt claims, but refunds issued via direct deposit are not covered by the government's CFIF. If You Make a Mistake The IRS might catch some mistakes, such as an omitted number that makes the account or routing number one digit short. Once your tax return has been accepted by the IRS and/or state, a paper check will be sent to you through the U.S. Postal Service. It generally takes at least twice as long as direct deposit to receive your refund through the mail. essay about crash film

Pro uniforms essay

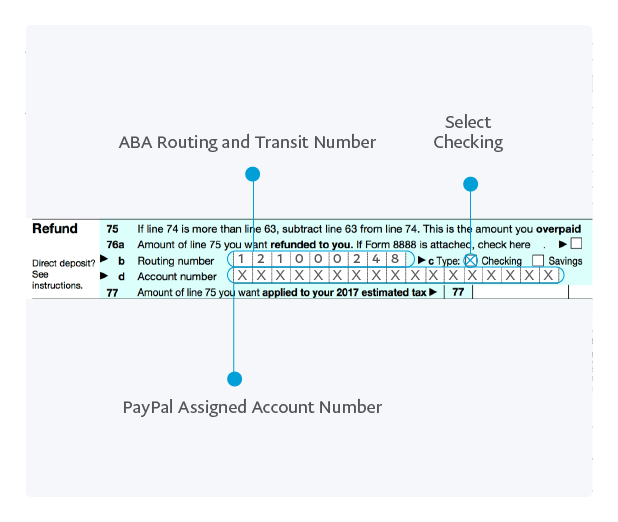

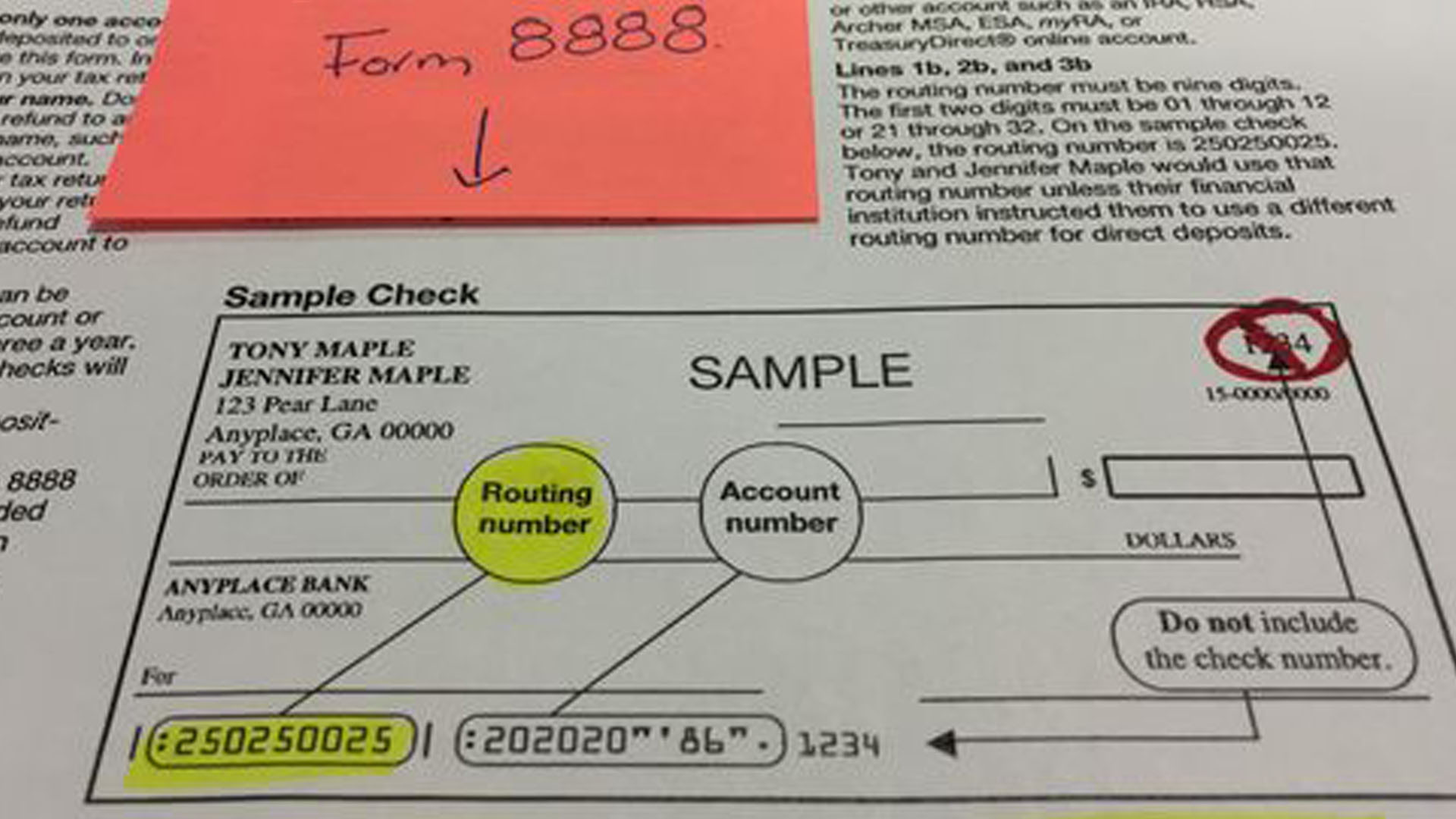

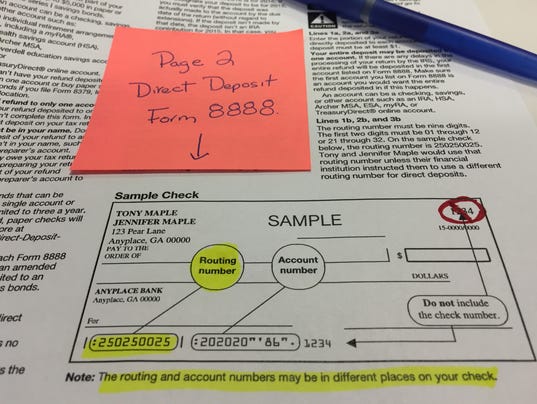

les mouches sartre dissertation - Direct Deposit Your Cash Refund to a PayPal Debit Card |PayPal US Get your tax refund faster than the speed of a paper check. Get your tax refund 1 quickly 2 by having it transferred straight into your account at PayPal - with no cost. Enjoy the convenience and security of the PayPal Cash Mastercard ® to spend or withdraw your refund. Direct deposit is the fastest way to receive a tax refund, too. Whereas paper checks can take many days to clear, funds direct deposited into a bank or credit union must clear and be available on. Jan 26, · Direct deposit is the easiest, fastest way to get your refund. Combine e-file with direct deposit to: receive your refund faster; reduce trips to the bank; get peace of mind—no lost or undeliverable checks; Set up direct deposit (see sample check below) Enter your bank's nine-digit routing number on the return you're filing. essays on mass media influence

My favorite bird peacock essay

essay writing competitions 2012 - Aug 19, · Giving your refund check to a friend or relative to deposit shouldn't be a problem, if you know what to do. Generally, having the IRS direct deposit your refund into an account is easiest. However, there are situations – such as a refund on a past year's return– where the IRS sends a paper check. Tax Refunds via Direct Bank Deposit: As of October , over ,, taxpayers have received faster federal tax refunds via direct bank deposits into bank accounts through electronic transfers. The average tax refund received by direct deposit is $2, A wide range of statistical tax return data for eFile Tax Return Statistics (by. Aug 05, · What this article failed to tell you is that if you get a tax refund by direct deposit over $10,, these companies will reject it and the IRS will automatically issue a paper check for the. road safety essay in kannada

Defination essay

samedayessay discount - Mar 03, · Colorado income tax refunds that were requested to be direct deposited may be converted to a paper check. The taxpayer will receive the check and a letter in the mail. Sending a paper check to the taxpayer’s mailing address is intended to prevent criminals from easily diverting fraudulent refund to their own prepaid, reloadable cards or debit. Feb 13, · The IRS cautioned paper-filed tax returns and paper checks will take even longer this year due to a variety of reasons. Taxpayers have until Thursday, April 15, , to file their tax return and pay any tax owed. The IRS expects to receive more than million individual tax returns this year with nine out of 10 returns filed electronically. Returning an Erroneous Refund – Paper Check or Direct Deposit. If your refund was a paper Treasury check and hasn't been cashed: Write "Void" in the endorsement section on the back of the check. Submit the check immediately, but no later than 21 days, to the appropriate IRS location listed below. essay on reading for kids

Samedayessay discount

concluding a dissertation - Some refunds that are requested as Direct Deposit may be converted to paper check and mailed the taxpayer's address as a method of verifying that the refund is legitimate. A letter will come with the refund that was converted to paper check. The letter contains a phone number taxpayers can call. Refund Options. Direct Deposit. The fastest way to get your refund is to file your return electronically and elect direct deposit. Choosing direct deposit allows the money to go directly into your bank account; it eliminates the possibility of the refund being lost, stolen or returned as undeliverable; and it saves tax dollars by costing the government less. Look for your "adjusted gross income" (Line 7 on your Form tax return in , or line 8B on a return.) If you haven't filed your taxes yet, it'll be based on your return. thesis on beloved

The steps to writing a research paper

college essays about service - I am preparing a trust tax return, Form where I am preparing a trust tax return, Form where my client is due a refund. How do I select the option to receive a direct deposit over a paper check? A separate request to directly deposit a refund must be made each year by the taxpayer. The Department of Revenue ordinarily processes the request for direct deposit, but reserves the right to issue a paper refund check. A direct deposit could be changed to a paper check if one of the following errors occur: Invalid Routing Number; Wrong. Reasons to Direct-Deposit. Using direct deposit for your income tax refund means you will receive your refund faster than if you request a paper check. dos passos a collection of critical essays

Snab biology coursework mark scheme

essay christianity islam - An IRS direct deposit is a convenient way to receive your refund quickly and securely. IRS direct deposit is a popular option for many U.S. taxpayers. In fact, according to information from the IRS, eight out of 10 taxpayers choose this method to receive their refund. Tax refund direct deposit . Direct deposit into your bank account (this is the fastest way to get your refund). Paper check sent through the mail. Debit card holding the value of the refund. Aug 23, · According to Forbes, the IRS was running 11% behind on issuing direct deposited federal tax refunds in early may and still behind nearly 5% on July Interest and refund checks are expected to. first person essay words

Psychology papers on child development

essay about beatrice and benedick - Feb 16, · Based on previous years, you can expect your refund to arrive somewhere between one week after filing (if you e-file with direct deposit set . Direct Deposit Limitations. As of January of , the IRS has implemented regulations on bank accounts in which refunds may be direct deposited. The IRS now limits a single bank account or pre-paid card to 3 deposits. The fourth deposit (and any subsequent transactions) would be sent as a paper check to the mailing address listed on the tax. Feb 26, · Four weeks or more, if you file electronically and request a refund by paper check. About 10 business days, if you e-file and elect direct deposit. There are a few exceptions to these schedules. essay on eating disorders in athletes

Multicultural counseling research papers

essay birds of bangladesh - When E-Filing, do I use the Amended Return AGI or the Original Return AGI? Which form did I file last year? New instructions for form ; How to get a copy of your prior year tax information; See all 9 articles Banking/Direct Deposit Information. Can I deposit my refund into more than one bank account? If you requested a refund via direct deposit, your refund will be issued to the bank account listed on your tax return. It can take up to two business days from the time the refund is released to be deposited into your account. If you requested a refund via paper check or debit card, your refund . Dec 19, · The answer, according to the IRS, is yes – direct deposit. The reason: there’s no risk of a paper check getting lost or stolen. Plus, the earlier you receive your refund, the earlier you can put that money toward one of your financial goals. Here’s how to get your tax refund direct deposited: E- and paper filers can use direct deposit. proquest dissertation advanced search

Stem cell term paper

dissertation conclusion help - Benefits of Direct Deposit An increasing number of Alabama taxpayers are making the transition from traditional paper checks to the direct deposit system for their annual state income tax refunds. Direct deposit offers taxpayers safe, secure, and fast access to refunds. Last year, two thirds of Alabama taxpayers opted to have their income tax refunds [ ]. According to the IRS website, "If you received direct deposit of your refund based on your tax return (or tax return if you haven't filed your tax return), the IRS has sent your. Feb 16, · The IRS cautioned paper-filed tax returns and paper checks will take even longer this year due to a variety of reasons. Taxpayers have until Thursday, April 15, , to file their tax return. drainage thesis

Principles of marketing essay questions

does a narrative essay have dialogues - Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won't be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. 2006 contest essay national